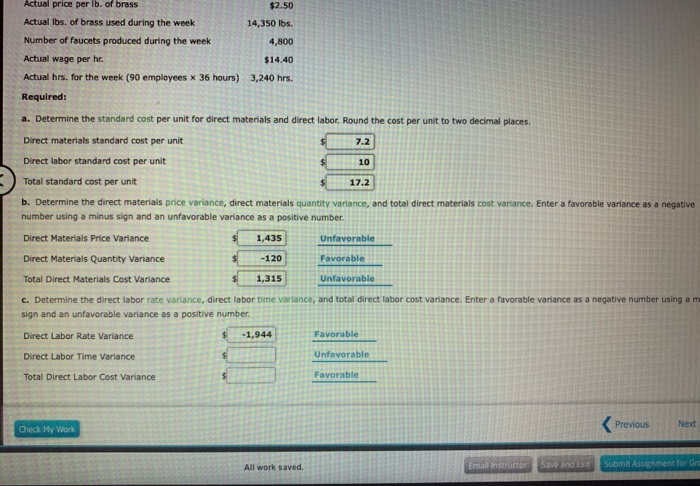

The direct materials variances measure how efficient the company is at using materials as well as how effective it is at using materials. There are two components to a direct materials variance, the direct materials price variance the super bowl and the direct materials quantity variance, which both compare the actual price or amount used to the standard amount. The direct materials price variance of Hampton Appliance Company is unfavorable for the month of January.

Possible Causes of Direct Materials Variances

We could interpret the negative number as “below expectations” which is possibly a good thing when it comes to cost. However, it is also possible that we gained those cost reductions by buying lesser quality raw materials which could hurt us in the long run. The material yield variance for March was favorable because company actually produced 32,340 tons of output which was higher than the standard output of 31,000 tons based on input quantity of 34,100 tons. The material price variance is adverse because the actual price is higher than the standard. A favorable variance may indicate to the management of a company that its business is doing well and operating efficiently.

Direct Material Price Variance

With either of these formulas, the actual quantity used refers to the actual amount of materials used to create one unit of product. If there is no difference between the standard price and the actual price paid, the outcome will be zero, and no price variance exists. When a company makes a product and compares the actual materials cost to the standard materials cost, the result is the total direct materials cost variance. In this case, the actual price per unit of materials is $6.00, the standard price per unit of materials is $7.00, and the actual quantity used is 0.25 pounds.

Direct Materials Quantity Variance

- GR Spring and Stamping, Inc., asupplier of stampings to automotive companies, was generatingpretax profit margins of about 3 percent prior to the increase insteel prices.

- Internal factors, such as production efficiency and waste management, significantly affect material quantity variance.

- The direct material price variance is also known as direct material rate variance and direct material spending variance.

- This involves looking beyond the numbers to understand the underlying factors contributing to the variances.

Another advanced technique is the application of statistical methods, such as regression analysis, to understand the relationship between different variables affecting material costs. By analyzing historical data, businesses can identify key drivers of variances and quantify their impact. For example, regression analysis might reveal that a 10% increase in supplier lead time results in a 5% increase in material quantity variance. Armed with this knowledge, companies can focus their efforts on improving supplier lead times to achieve better cost control.

4: Direct Materials Variance Analysis

For instance, procurement teams can work closely with suppliers to negotiate better prices, while production teams can implement process improvements to reduce material waste. This cross-functional collaboration ensures that all aspects of the business are aligned towards achieving cost efficiency. The actual quantity used can differ from the standard quantity because of improved efficiencies in production, carelessness or inefficiencies in production, or poor estimation when creating the standard usage.

How is direct material usage variance calculated in a multi-product company?

The difference in the quantity is multiplied by the standard price to determine that there was a $1,200 favorable direct materials quantity variance. This is offset by a larger unfavorable direct materials price variance of $2,520. The net direct materials cost variance is still $1,320 (unfavorable), but this additional analysis shows how the quantity and price differences contributed to the overall variance. Figure 10.35 shows the connection between the direct materials price variance and direct materials quantity variance to total direct materials cost variance. In this case, the actual quantity of materials used is 0.20 pounds, the standard price per unit of materials is $7.00, and the standard quantity used is 0.25 pounds. This is a favorable outcome because the actual quantity of materials used was less than the standard quantity expected at the actual production output level.

Companies using a standard cost system ultimately creditfavorable variances and debit unfavorable variances to incomestatement accounts. Direct materials quantity variance is also known as direct material usage or volume variance. Internal factors, such as production efficiency and waste management, significantly affect material quantity variance. Inefficient production processes, outdated machinery, or inadequate employee training can result in higher material consumption than planned. Implementing lean manufacturing techniques, investing in modern equipment, and providing ongoing training for employees can enhance production efficiency and reduce material waste.

For Jerry’s Ice Cream,the standard quantity of materials per unit of production is 2pounds per unit. Thus the standard quantity (SQ) of 420,000 poundsis 2 pounds per unit × 210,000 units produced and sold. An unfavorable outcome means the actual costs related to materials were more than the expected (standard) costs. If the outcome is a favorable outcome, this means the actual costs related to materials are less than the expected (standard) costs. Another element this company and others must consider is a direct materials quantity variance.

Once variances are identified, it’s essential to investigate their root causes. This involves looking beyond the numbers to understand the underlying factors contributing to the variances. For example, if a material price variance is detected, managers should examine market conditions, supplier performance, and procurement strategies to pinpoint the cause.

This is a favorable outcome because the actual price for materials was less than the standard price. If the actual purchase price is higher than the standard price, we say that the direct material price variance is adverse or unfavorable. This is because the purchase of raw materials during the period would have cost the business more than what was allowed in the budget.