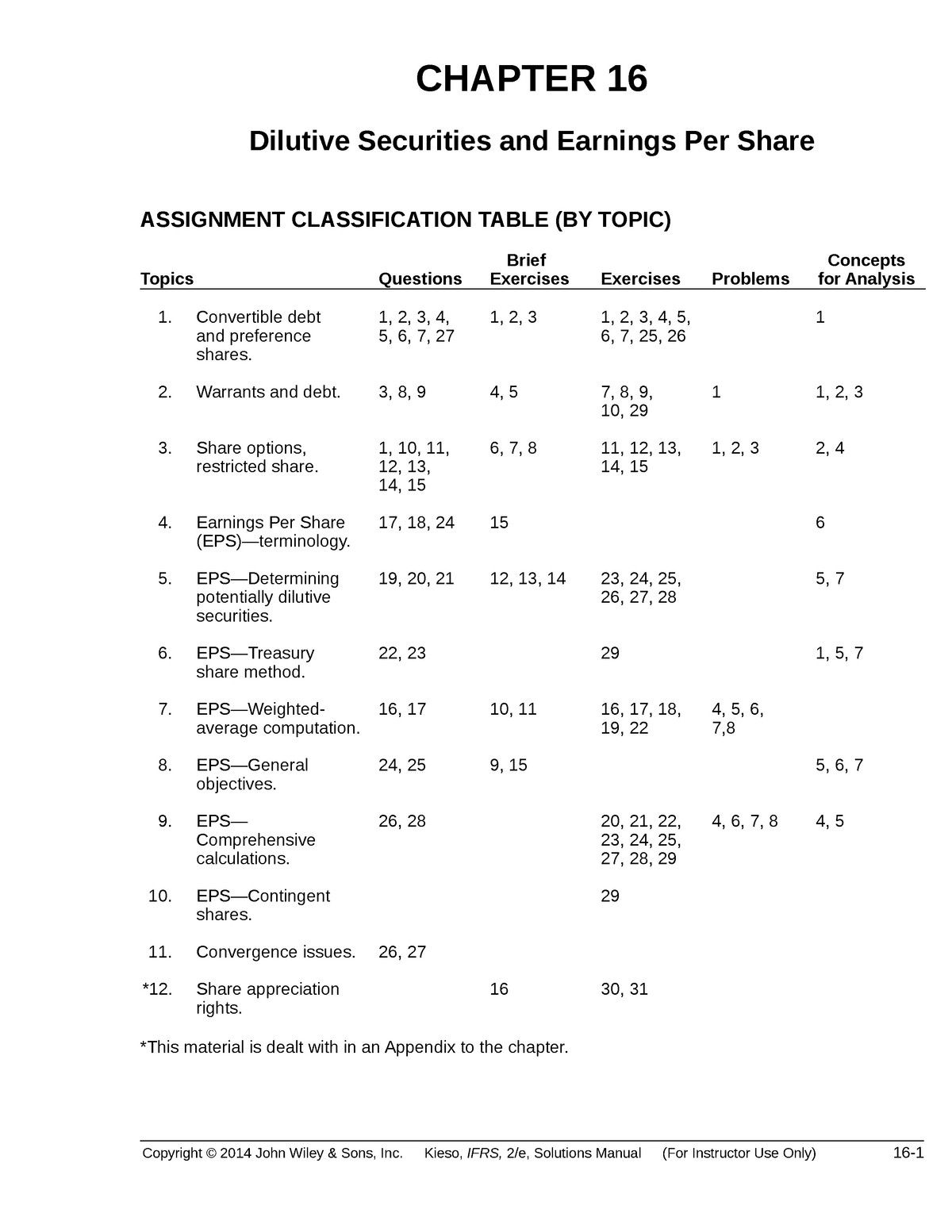

When a company issues convertible debt, it means that debt holders who choose to convert their securities into shares will dilute current shareholders’ ownership. In many cases, convertible debt converts to common stock at some preferential conversion ratio. For example, each $1,000 of convertible debt may convert to 100 shares of common stock, thus decreasing current stockholders’ total ownership. Public companies may also calculate diluted EPS to determine the potential effect of dilution on stock prices in case stock options are exercised. Dilution results in a decline in the book value of the shares and the earnings per share of the company.

Importance of Fully Diluted EPS in Investment Decisions

Fully diluted shares outstanding are the total number of shares a company would theoretically have, including basic shares outstanding, if all dilutive securities were exercised and converted into shares. Dilutive securities include options, warrants, convertible debt, and anything else that can be converted into shares. Convertible preferred stocks are a type of security that can be converted into common stock at a later date. When convertible preferred stocks are converted into common stock, the number of outstanding shares increases, which can impact the fully diluted EPS calculation.

AccountingTools

Instead, they are based on Disc’s current beliefs, expectations and assumptions regarding the future of Disc’s business, future plans and strategies, clinical results and other future conditions. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. The primary eps is the net income divided by the number of shares outstanding at the end of a reporting period.

How Does a Diluted EPS Affect Shareholders?

Shares can also be diluted by employees who have been granted stock options. Investors should be particularly mindful of companies that grant employees a large number of optionable securities. There are many scenarios in which a firm could require an equity capital infusion.

Company

- Below is a break down of subject weightings in the FMVA® financial analyst program.

- The concept is of importance when calculating fully diluted earnings per share, where the effect of these securities can reduce earnings per share.

- For example, each $1,000 of convertible debt may convert to 100 shares of common stock, thus decreasing current stockholders’ total ownership.

- For example, companies in the technology industry may have more stock options and warrants than companies in the manufacturing industry.

- Since the share of a company’s stock represents the ownership stake in the company, the shareholders who purchased the IPO will now have a smaller stake in the ownership of the company.

The potential upside of raising capital in this way is that the funds the company receives from selling additional shares can improve the company’s profitability and growth prospects, and by extension the value of its stock. But if the owners of these convertible preferred stocks want, they can convert their preferred stocks into common stocks. In simple terms, we call the financial instruments accounts payable vs notes payable dilutive securities if they increase the number of outstanding shares. It means that such securities are those instruments that can easily convert into common shares. When warrants are exercised, the number of outstanding shares increases, which can impact the fully diluted EPS calculation. The Treasury stock method is used to calculate diluted EPS for potentially dilutive options or warrants.

What is Dilution?

Group C will not be dilutive because its savings per share of $4.50 is larger than the $4.30 just obtained. Thus, the $4.30 figure is the smallest fully diluted figure and should be reported on Sample’s income statement. To determine if this point is maximum dilution, alternate calculations can be made. These calculations involve bringing in the savings and new shares in order from the most to the least dilutive. If bonds convertible to 200,000 shares can offer interest savings of $400,000, the result would be $6,600,000 / 1,600,000, or a loss of $4.13 per share. By understanding the fully diluted EPS calculation and its limitations, investors can make more informed investment decisions.

In order to help you advance your career, CFI has compiled many resources to assist you along the path. You can see that by considering the diluted securities, the diluted EPS would reduce. Private companies are not required to report their financials, including EPS and diluted EPS. Stock equivalents potentially dilute eps when they provide a mechanism by which net income may be distributed to shareholders in the form of dividends or share repurchases.

Since the conversion price is greater than the current share price, the warrants are dilutive and we assume conversion. This will result in warrant holders receiving 150 additional common shares for a payment of $6,000 ($40 x 150) to the company. We assume that the company will utilize the $6,000 proceeds to buy back 100 common shares at the current market price of $60, resulting in a net dilution of 50 shares. These are contracts that give the owner the right to purchase common stock at a given price at a given time. When stock options are exercised, the options become common shares and increase the number outstanding. The treasury stock method assumes that all of the money securities are converted into additional shares and proceeds from these additional shares are used to repurchase the company’s shares.