This can make it difficult to compare fully diluted EPS across different periods. Non-recurring events and exceptional items can also impact the fully diluted EPS calculation. This could indicate that the company is not generating enough profits or that it has a higher potential for dilution. Investors can use this information to identify companies that are more profitable and have better financial performance.

Do you already work with a financial advisor?

Dilution protection refers to contractual provisions that limit or outright prevent an investor’s stake in a company from being reduced in later funding rounds. The dilution protection feature kicks in if the actions of the company will decrease the investor’s percentage claim on assets of the company. It has implications when you’re calculating fully diluted earnings per share. Dilution protection refers to contractual provisions that limit or outright prevent an investor’s stake in a company from being reduced in later funding rounds.

- After-tax interest on the convertible debt is added to the net income in the numerator and the new common shares that would be issued at the conversion are added to the denominator.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- These assumptions and estimates may not always be accurate, which can impact the accuracy of the fully diluted EPS calculation.

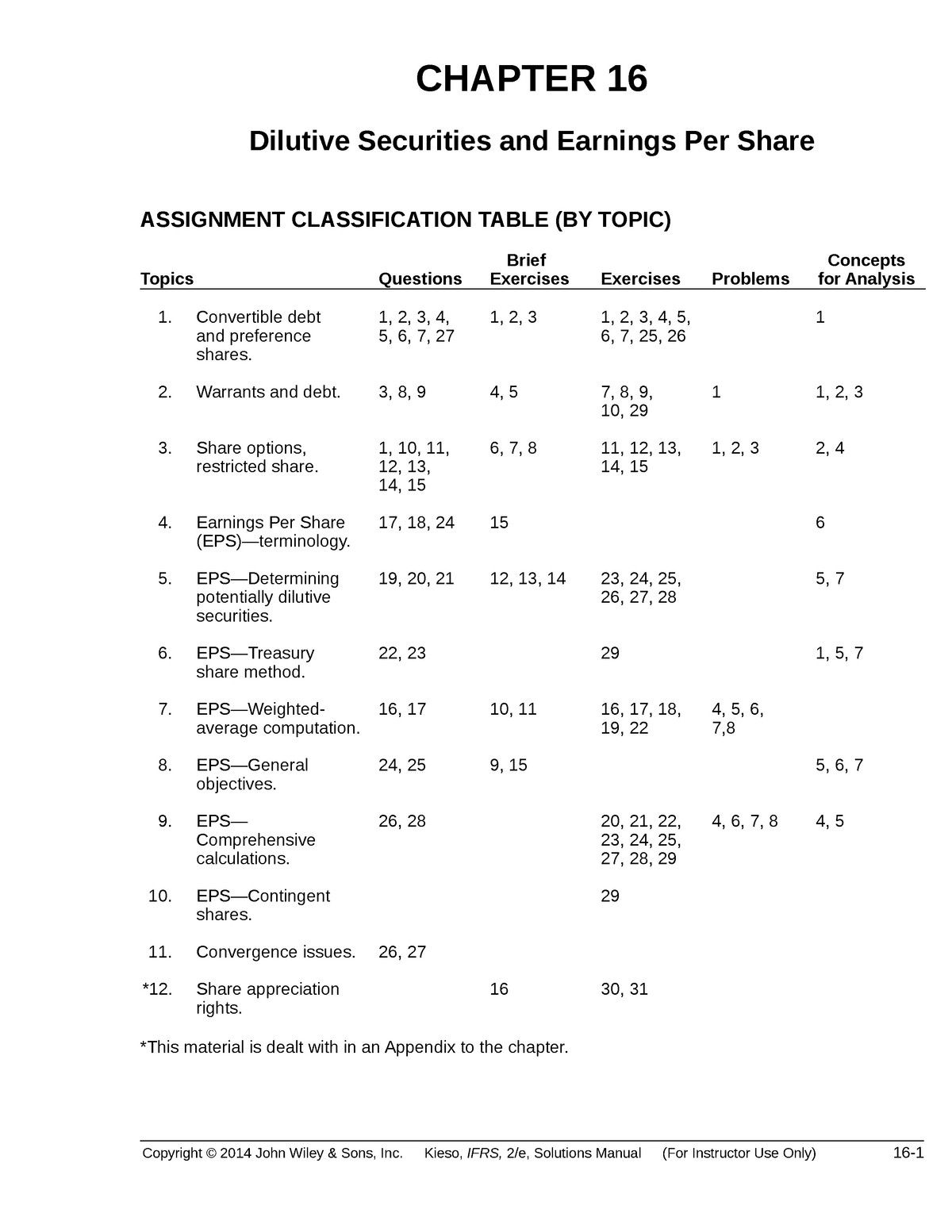

- The fully diluted EPS calculation goes a step further and considers the impact of all potentially dilutive securities on the number of outstanding shares.

- When convertible preferred stocks are converted into common stock, the number of outstanding shares increases, which can impact the fully diluted EPS calculation.

What is the primary eps?

In situations where a company splits its stock, current investors receive additional shares while the price of the shares is adjusted accordingly, keeping their percentage ownership in the company static. Diluted EPS indicates a worst-case scenario that reflects the consequence of all dilutive shares such as options, warrants, and convertible preferred shares, converted simultaneously. The potential for dilution of the company’s shares may concern analysts and investors. When stock options are exercised, the number of outstanding shares increases, which can impact the fully diluted EPS calculation.

Cause of Share Dilution

The options or warrants are considered dilutive if their exercise price is below the average market price of the stock for the year. Therefore, shareholders’ ownership in the company is reduced, or diluted when these new shares are issued. In securities, when a company’s value or earnings per share (EPS) is reduced, that results in a dilutive effect. This can happen during a merger or acquisition when the number of common shares is increased and the target company’s profitability is lower than that of the acquiring company. The extent of the reduction in EPS is directly proportional to the percentage increase in the number of shares. As you can see, there are many different types of securities that can affect the number of outstanding shares of common stock.

Understanding Dilution

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. In this case, there is no change in the numerator and an increase in the denominator, resulting in reduction in EPS.

Stock options and similar securities come with a vesting period, usually a few years, before they can be exercised. This may result in employees leaving before the vesting period is over, leading companies to inaccurately estimate the number of options that will be vested. Below is a break down of subject weightings in the FMVA® financial analyst program.

A company must make adjustments to its earnings per share and ratios for its valuation when dilution occurs. Investors should look out for signs of potential share dilution and understand how it could affect the value of their shares and their overall investment. In addition to information about significant accounting practices and tax rates, footnotes usually describe what factored into the diluted EPS calculation. The company may provide specific details regarding stock options granted to officers and employees and their effects on reported results. After all, by adding more shareholders into the pool, their ownership of the company is being cut down.

The new share price of the company will be lower than its share price before dilution. The reason for this is that the market capitalization of the company is divided by a greater number of shares. The markets factor this in, and the result is a decrease in the company’s share price. Dilution protection provisions are generally found in venture capital funding agreements.

Diluted EPS is a performance metric used to assess a company’s earnings per share if all convertible securities were exercised. Dilution devalues a shareholder’s existing equity stake and reduces a firm’s earnings per share. Publicly traded companies must report both EPS and diluted EPS on their earnings report.

That may lead shareholders to believe their value in the company is decreasing. In certain cases, investors with a large chunk of stock can often take advantage of shareholders that own a smaller as a dependent 2020 portion of the company. Suppose the company then issues 10 new shares and a single investor buys them all. There are now 20 total shares outstanding and the new investor owns 50% of the company.