Without this knowledge, it can be challenging to understand the balance sheet and other financial documents that speak to a company’s health. The auditor of the company then subjects balance sheets to an audit. Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper. On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant. Balance sheets include assets, liabilities, and shareholders’ equity.

Would you prefer to work with a financial professional remotely or in-person?

The Balance Sheet is one of the three financial statements businesses use to measure their financial performance. The other two are the Profit and Loss Statement and Cash Flow Statement. The Balance Sheet shows a company’s assets, liabilities, and shareholders’ equity. In this section all the resources (i.e., assets) of the business are listed. In the balance sheet, assets having similar characteristics are grouped together.

Limitations of Balance Sheets

- In other words, it’s your money, not the bank’s, so it’s not considered a bank asset.

- While stakeholders and investors may use a balance sheet to predict future performance, past performance does not guarantee future results.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- The second is earnings that the company generates over time and retains.

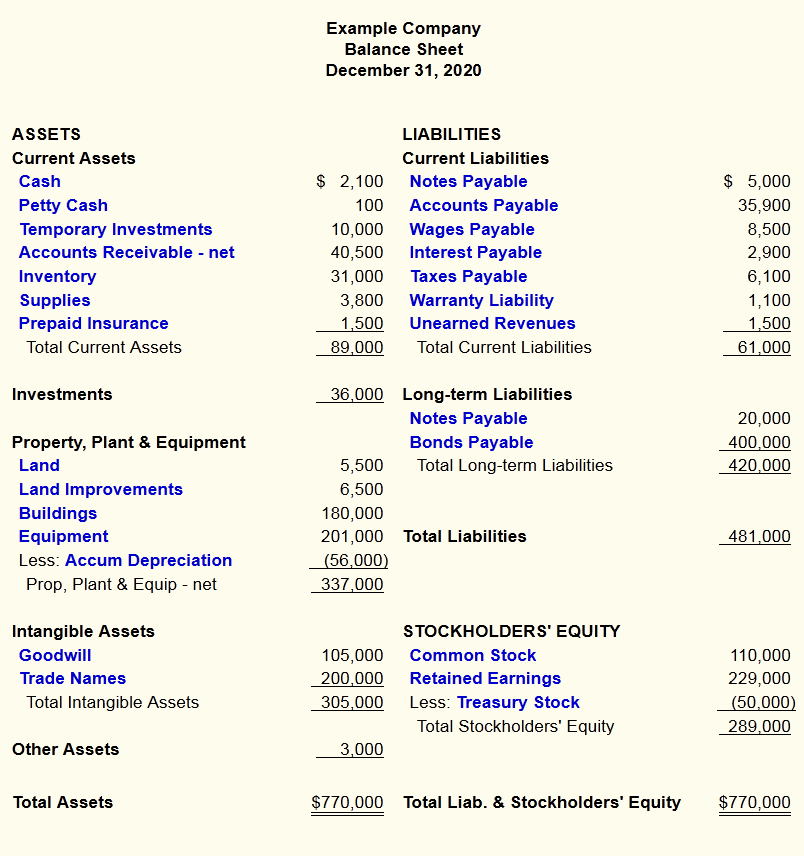

Liabilities are financial and legal obligations to pay an amount of money to a debtor, which is why they’re typically tallied as negatives (-) in a balance sheet. We’ll do a quick, simple analysis of two balance sheets, so you can get a good idea of how to put financial ratios into play and measure your company’s performance. Investors, business owners, and accountants can use this information to give a book value to the business, but it can be used for so much more. Balance sheets are typically prepared at the end of set periods (e.g., annually, every quarter). Public companies are required to have a periodic financial statement available to the public.

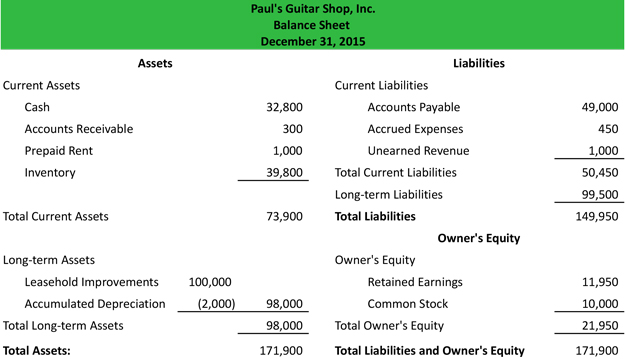

Formatting a Balance Sheet

While the financial statements are closely intertwined and necessary to understand a company’s financial health, the balance sheet is particularly useful for ratio analysis. How assets are supported, or financed, by a corresponding growth in payables, debt liabilities, and equity reveals a lot about a company’s financial health. A company’s balance sheet comprises assets, liabilities, and equity. Assets represent things of value that a company owns and has in its possession, or something that will be received and can be measured objectively. Liabilities are what a company owes to others—creditors, suppliers, tax authorities, employees, etc.

Analyzing Asset Quality and Utilization

Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued. For example, equity capital is often the last item to be recovered, when a business ceases, for example. A higher number means the company is better positioned to do this.

Companies are required by law to generate these financial statements. With this information, stakeholders can also understand the company’s prospects. For instance, the balance sheet can be used as proof of creditworthiness when the company is applying for loans. By seeing whether current assets are greater than current liabilities, creditors can see whether the company can fulfill its short-term obligations and how much financial risk it is taking.

Importantly, the cash conversion cycle is an important indicator of a company’s working capital, which is the difference between its current assets and current liabilities. Balance Sheets include assets, liabilities, and shareholders’ equity. Assets are everything that a business owns and can use to pay its debts. Shareholders’ equity is the difference between a company’s assets and liabilities.

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay will the 2022 income tax season be normal its short-term debts. If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. Its liabilities (specifically, the long-term debt account) will also increase by $4,000, balancing the two sides of the equation.

The comparative balance sheet presents multiple columns of amounts, and as a result, the heading will be Balance Sheets. The additional column allows the reader to see how the most recent amounts have changed from an earlier date. A drawback of the account form is the difficulty in presenting an additional column of amounts on an 8.5″ by 11″ page.

At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments. A balance sheet captures the net worth of a business at any given time. It shows the balance between the company’s assets against the sum of its liabilities and shareholders’ equity — what it owns versus what it owes. This financial statement lists everything a company owns and all of its debt.