Below is a typical balance sheet example; each link provides further details and how to account for them. Inventory stock includes all items a business possesses with the intention of selling, including products currently in stock. Various techniques, such as the first in, first out (FIFO) and last in, first out (LIFO) methods, are used for calculating stock levels.

- Updates to your application and enrollment status will be shown on your account page.

- Pay attention to the balance sheet’s footnotes in order to determine which systems are being used in their accounting and to look out for red flags.

- HBS Online’s CORe and CLIMB programs require the completion of a brief application.

- Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

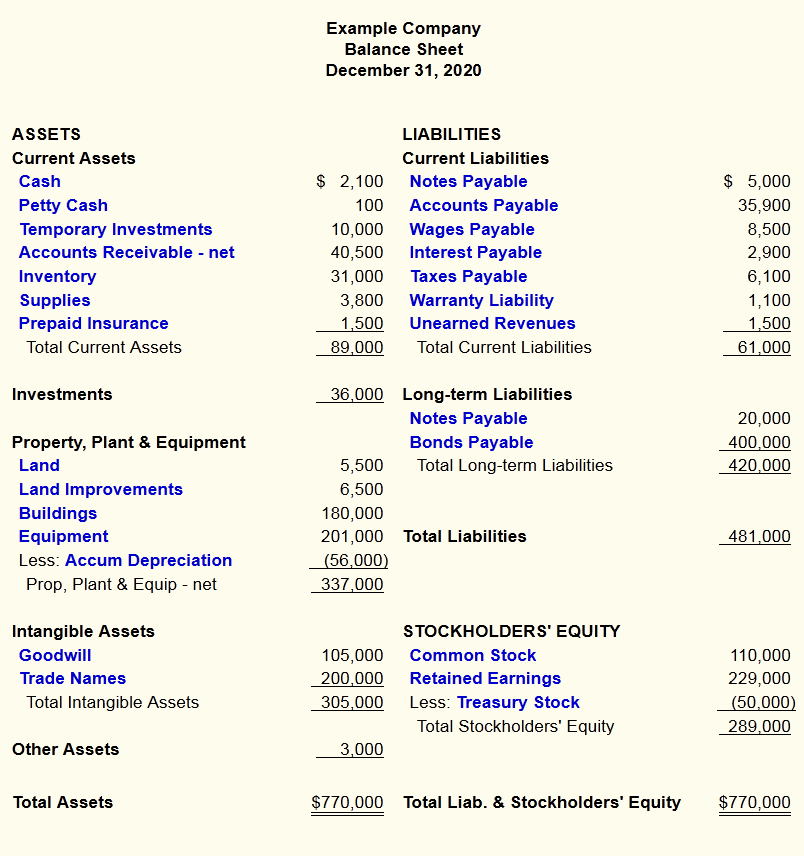

Report format:

Shareholders’ equity belongs to the shareholders, whether public or private owners. Current liabilities refer to the liabilities of the company that are due or must be paid within one year. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for equity financing teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. It can be sold at a later date to raise cash or reserved to repel a hostile takeover.

Business Insights

If the company wanted to, it could pay out all of that money to its shareholders through dividends. However, the company typically reinvests the money into the company. Current assets are typically those that a company expects to convert easily into cash within a year. A balance sheet is a financial document that you should work on calculating regularly. If there are discrepancies, that means you’re missing important information for putting together the balance sheet.

The hassle-free international business account.

As you can see, the report format is a little bit easier to read and understand. Plus, this report form fits better on a standard sized piece of paper. These are typically liquid, or likely to be realised within 12 months.

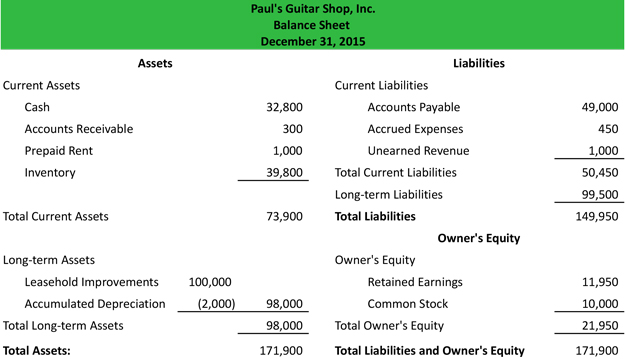

Example of a balance sheet using the account form

This form is more of a traditional report that is issued by companies. Assets are always present first followed by liabilities and equity. When you start a business, you’ll often need to finance it with your own money. It’s important to capture this in the equity section of the balance sheet — even though it wouldn’t be considered the same as a loan from the bank. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts.

A Crucial Understanding

The balance sheet is used to assess the financial health of a company. Investors and lenders also use it to assess creditworthiness and the availability of assets for collateral. The data and information included in a balance sheet can sometimes be manipulated by management in order to present a more favorable financial position for the company. The balance sheet only reports the financial position of a company at a specific point in time.

In order to get a complete understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement. Balance sheets measure profitability and keep your finger on the pulse of a firm’s financial health. When paired with other financial statements and accounting software, they offer context for a business’s financial position. Whether you’re facing a downturn or expecting growth, the balance sheet can help explain why. As described at the start of this article, a balance sheet is prepared to disclose the financial position of the company at a particular point in time.

We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. No, all of our programs are 100 percent online, and available to participants regardless of their location.

The report is used by business owners, investors, creditors and shareholders. Current liabilities refer to debts or financial obligations that must be settled within a year. Many businesses manage a variety of these liabilities, including accounts payable, deferred revenue, taxes payable, and salaries payable. Vigilant monitoring of your current liabilities is crucial, as excessive debt can pose a significant financial risk to your business. The cash flow statement is another important financial statement that shows a company’s cash inflows and outflows over a specific period. You can use this report to see how your business is doing overall and whether it has enough cash to cover its expenses.