1) It helps you determine how much money your business generates on every dollar of sales. You can use this information to determine whether your business is profitable or not and whether it is growing or not (if your contribution margin percentage changes). Knowing how to calculate the contribution margin is an invaluable skill for managers, as using it allows for the easy computation of break-evens and target income evaluate the hr budget planning proposal and negotiation strategy workshop sales. This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses. Let’s say we have a company that produces 100,000 units of a product, sells them at $12 per unit, and has a variable costs of $8 per unit. To stay competitive, they increasingly turn to sophisticated tools like cost behavior analysis and contribution margin calculations.

How does the contribution margin affect profit?

This will help you establish fair prices that are attractive for patients and cover the cost of providing care. Knowing how to calculate contribution margin allows us to move on to calculating the contribution margin ratio. To get the ratio, all you need to do is divide the contribution margin by the total revenue. It is the monetary value that each hour worked on a machine contributes to paying fixed costs. You work it out by dividing your contribution margin by the number of hours worked on any given machine. A contribution margin analysis can be done for an entire company, single departments, a product line, or even a single unit by following a simple formula.

- In essence, never go below a contribution per unit of zero; you would otherwise lose money with every sale.

- Fixed costs are often considered sunk costs that once spent cannot be recovered.

- You may also look at the following articles to enhance your financial skills.

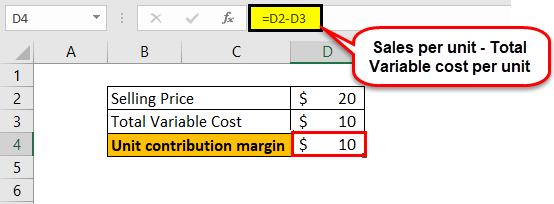

Formula For Contribution Margin

Additionally, it assists in setting pricing strategies to ensure that products are priced appropriately to cover both variable and fixed costs while maximizing overall profitability. Overall, the unit contribution margin provides valuable insights into the financial performance of individual products or units and helps guide strategic decision-making within organizations. For small business owners, effectively using a contribution margin calculator means regularly updating it with accurate data. Keeping track of changes in variable costs or selling prices per unit is essential for the accuracy of the calculation.

Role in Pricing Strategies and Cost Control

We explain its formula, differences with gross margin, calculator, along with example and analysis. You may also look at the following articles to enhance your financial skills. When there’s no way we can know the net sales, we can use the above formula to determine how to calculate the contribution margin. This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set. Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit.

Management should also use different variations of the CM formula to analyze departments and product lines on a trending basis like the following. A high contribution ratio tells us that you’re earning enough to pay for all your expenses, with extra leftover for savings, investments, and other goals. A low ratio indicates that you may be spending more than you earn, leaving you with no money for savings. The contribution margin is given as a currency, while the ratio is presented as a percentage. For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit.

Our Services

This insight is invaluable for making decisions about product mix, pricing strategies and resource allocation. For example, a product with a high contribution margin might be worth promoting more aggressively, even if its overall profit margin seems lower initially. To master cost-behavior analysis, business leaders employ a variety of techniques. They immerse themselves in historical data, searching for patterns that reveal how costs have responded to activity changes in the past. Some use statistical tools like regression analysis to quantify these relationships more precisely.

Calculate the company’s contribution margin for the period and calculate its breakeven point in both units and dollars. The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68. Profits will equal the number of units sold in excess of 3,000 units multiplied by the unit contribution margin. However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio. Fixed costs are often considered sunk costs that once spent cannot be recovered. These cost components should not be considered while making decisions about cost analysis or profitability measures.

If the selling price per unit is more than the variable cost, it will be a profitable venture otherwise it will result in loss. The Contribution Margin Ratio is a key financial metric that offers insights into the efficiency of your product line and sales strategy. It is expressed as a percentage and illustrates what portion of each sales dollar contributes to covering fixed costs and generating profit. This ratio is particularly useful in evaluating the profitability of different products or services within your business. By analyzing the unit contribution margin of different products or units, companies can identify their most profitable offerings and allocate resources accordingly.

This highlights the margin and helps illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected. Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin.